NCMC Card Services

NCMC & EMV Open loop ticketing solution for Metro, Bus, Parking, etc.

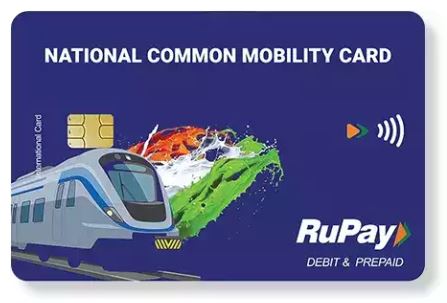

The National Common Mobility Card (NCMC) is an interoperable, contactless smart card initiative by the Government of India that enables seamless travel and digital payments across multiple transport systems and retail services. It is based on EMV open-loop standards, allowing users to make secure payments both online and offline.

Supporting QR, NFC, EMV, NCMC, and Stored Value cards, it ensures fast and secure transactions across multiple fare media. Designed for pole-mounted onboard use or as a platform validator at at-grade tram and BRT stations, it adapts effortlessly to various transit environments.

Uses of NCMC Card

- Streamlines travel: Eliminates multiple tickets/cards across cities or transport modes.

- Cashless efficiency: Tap‑and‑go avoids queues, change hassles.

- Versatile: Works beyond transport—at tolls, retail, parking, ATM withdrawals.

- Nationwide mobility: As more metros & cities adopt NCMC, your card gains utility nationally.

- Public Transportation: Metro rail, city buses, suburban rail, and rapid transit systems.

- Toll & Parking Payments:FASTag-linked toll plazas and parking facilities.

- Retail & Merchant Payments: Small and large merchant outlets supporting contactless payments.

- Smart City Services: Integrated mobility and urban services under smart city initiatives.

- Inter-City & Multi-Modal Travel: Enables seamless travel across different cities and transport operators.

Key Features

- Interoperable & Open Loop: Works across metros, buses, suburban rail, toll plazas, parking, and retail outlets nationwide.

- Contactless Payments: Tap-and-go functionality using NFC technology for quick and secure transactions.

- Multi-Application Support: Supports transit fares, retail purchases, parking fees, and toll payments on a single card.

- Offline Transaction Capability: Enables payments even in low-connectivity environments, ideal for transit systems.

- Secure & EMV-Based: Built on EMV standards with encryption and secure authentication.

- Bank-Issued Card: Issued by participating banks and linked to a customer’s bank account.

- Reloadable & Easy Top-Up: Supports recharge via online banking, UPI, ATMs, and bank branches.

EMV (Europay, Mastercard, and Visa) cards are secure payment cards embedded with a microprocessor chip that enables authenticated, encrypted, and contactless or contact-based transactions. EMV technology is the global standard for card payments and is widely used in banking, retail, transit, and digital payment systems. An EMV card is a type of payment card that uses a microprocessor chip for secure transactions. EMV stands for Europay, MasterCard, and Visa, the three companies that developed the standard.

- Chip Technology: - Contains an embedded microchip that encrypts transaction data, making it harder to clone or counterfeit than traditional magnetic stripe cards.

- Secure Authentication: - Each transaction generates a unique code, which makes it very difficult for fraudsters to reuse stolen data.

- Global Standard: - EMV is widely adopted around the world and is considered the global standard for card payments.

- Dual Functionality: - Most EMV cards also have a magnetic stripe for backward compatibility and support contactless (tap-to-pay) functionality.

EMV Card - Key Services

- Contactless & Contact-Based Payments: Supports tap-and-go (NFC) as well as chip-and-PIN transactions.

- Secure Authentication: Dynamic transaction data generation for every payment, reducing fraud.

- Payment Network Integration: Compatible with Visa, Mastercard, RuPay, and other card networks.

- Transit & Mobility Enablement: Supports open-loop ticketing systems for metro, bus, rail, and toll payments.

- Offline Transaction Support: Enables low-value offline approvals, ideal for transit environments.

- Tokenization & Encryption: Protects sensitive card data through secure cryptographic mechanisms.

- Back-Office & Settlement Support: Integration with acquiring banks, payment gateways, and settlement systems.

Uses of EMV Cards

- Retail & Merchant Payments: In-store, POS, and e-commerce transactions.

- Public Transport & Ticketing: Metro rail, buses, suburban rail, tolls, and parking.

- Banking & Financial Services: ATM withdrawals, balance inquiries, and account access.

- Smart City Applications: Integrated payments for urban mobility and services.

- Tourism & Travel: Hotels, airports, and international travel payments.